Key Takeaways:

Costco business is an American international business that generates rapid inventory turnovers and high sales volumes. Their principal strategy is limited selection and low prices.

Their majority of revenues are from retail sales and a small share from membership fees. Costco’s business model is making it unbeatable, even in and against the retail industry.

Costco has become the go-to destination for a large type of products purchasers choose to buy in-person, as opposed to online, as opposed to cars, gasoline, and groceries.

By turning into one of the best-value choices for things that shoppers wish to get at brick-and-mortar locations, the corporate has still competed against swiftly-growing e-commerce companies like Amazon.

Company Profile:

| Company Name | Costco Wholesale Corporation © |

| Website | costco.com |

| Founded- In: | July 12, 1976 |

| Headquarters: | Issaquah, Washington, U.S. |

| Founder | James Sinegal, Jeffrey Brotman |

| Key People | Hamilton E. James (Chairman) W. Craig Jelinek (President and CEO) |

| Business Model | Public Platform |

| Product/Services | Merchandise, Cash & Carry, Warehouse club, Filling stations |

| Competitive Advantage | Low costs, Restricted product lines, and choice, Treasure hunt shopping atmosphere |

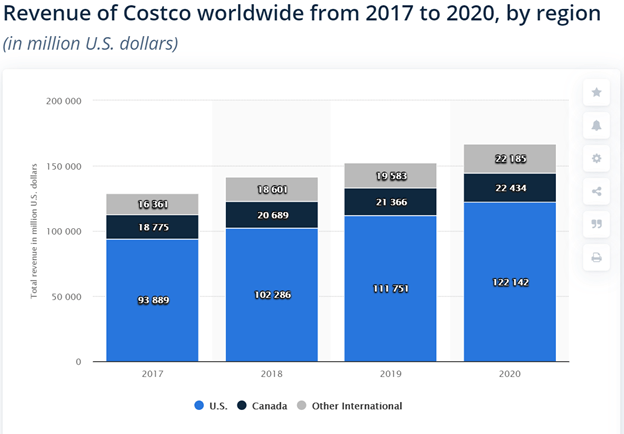

| Revenue | $122.14 billion for the U.S in 2020 |

| IPO | Mar 12, 1982 |

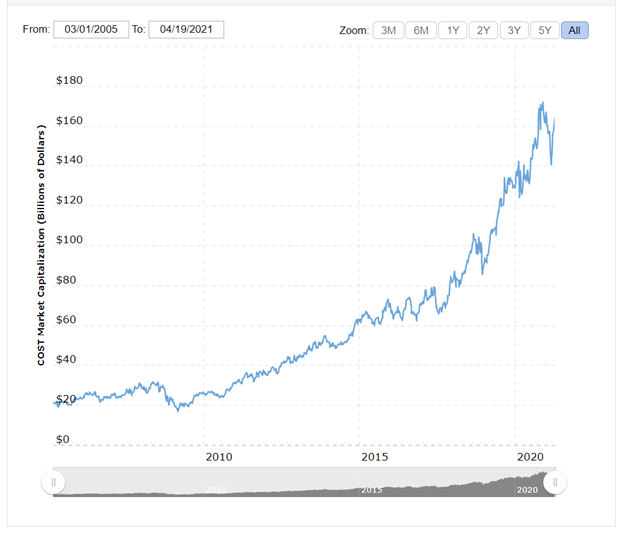

| Net worth | $160.72 Billion (16 April 2021) |

| Competitors | Walmart Inc. (NYSE: WMT) Target Corporation (NYSE: TGT) |

Introduction:

Costco is a wholesale and retail merchant retailer of discounted products online and through membership warehouses.

The two fastest-growing areas are fresh foods and hardlines merchandise like hardware and huge appliances. International operation is the fastest-growing section.

Costco Wholesale Corporation (Well known merely as Costco and doing business as Costco Wholesale) is an American international corporation that operates a sequence of membership-only big-box retail stores.

Costco was the fifth largest merchandiser in 2020 the world, therefore the world’s largest merchandiser of alternative and prime beef, organic foods, rotisserie chicken, and wine as of 2016. In 2021, Costco was graded #10 on the Fortune five hundred rankings of the most important U.S. firms by total revenue.

Costco’s worldwide headquarters are located in Issaquah, Washington, an eastern suburb of Seattle, through its Kirkland Signature house label that endures the name of its previous location in Kirkland.

The corporate opened its initial warehouse (the chain’s term for its retail outlets) in Seattle in 1983. However, through mergers, Costco’s company history dates back to 1976, when its former rival price Club was based in San Diego, California.

As of March 2021, Costco has 804 warehouses worldwide: 558 within the U.S. (including Puerto Rico and the District of Columbia), 103 in Canada, thirty-nine in Mexico, twenty-nine within the U.K., twenty-seven in Japan, sixteen in South Korea, fourteen in Taiwan, twelve in Australia, 3 in Spain, one in Iceland, one in France, and one in China.

The corporate plans to open new warehouses in New Zealand and Sweden in early 2022.

What is Costco’s Business Model?

The business model is used to exemplify the strategies and ways they tend to use to generate planned revenue. Costco’s business model is to get high sales volume and fast inventory turnover by providing low costs on the restricted choice of national branded and choose private-label merchandise in a wide range of merchandise classes.

Costco offers this merchandise to its members of two types business members and gold star members. This business model is tempting due to it provides a look at Costco’s management to still devise ways and strategies through which they will keep hold of existing members and gain the attention of the latest members.

Otherwise, they’ll suffer failure due to there’ll be a risk that discontented members won’t renew their membership. This business model takes the company towards total quality management.

Costco’s strategy’s components are:

• Low costs

• restricted product lines and choice

• treasure hunt shopping atmosphere

Costco is following a value leadership strategy that is nice; as a result of this base, they will compete with their competitors. By restricted product lines and restricted choice, they provide restricted 4000 things that are less than their competitors.

Costco has adopted a market development strategy by capturing new markets for existing merchandise. By treasure hunt shopping atmosphere, they provide such products at low costs to its members that they believe will not be obtainable on the next visit.

This works as motivation, and members try to take most advantage, and thus Costco’s sales volume will increase. At Costco’s warehouse, products aren’t offered in each size.

The strategy they followed is that by providing each size, their efficiency can decrease, so it’s said the intelligent loss of sales.

A Short History of Costco Business Model:

Costco begins its history back in 1976, when Sol price, a pioneer in warehouse club marketing, opened the primary price Club in San Diego. Jeffrey H. Brotman and James D. Sinegal opened the primary Costco in Seattle in 1983. the price Company (corporate parent of price Club) and Costco unified in 1993 to become Price/Costco.

In 1997 the company name was modified to Costco firms, Inc., and in 1999 the current company name was adopted. Within the early twenty-first century, the corporate operated stores within the U.S, Canada, Mexico, Europe, the far east, and Australia.

The corporate was usually praised for providing its staff with higher pay and higher benefits than were customary within marketing.

What is the Business Model of Costco Business?

Costco’s business model is to develop high sales volumes and speedy inventory turnover by giving members low costs on a restricted choice of nation-branded and selected private-label merchandise in an extensive range of merchandise.

Costco’s business model is made upon client memberships, which be part of and renew annually. This directly shows client loyalty as glad customers can renew annually.

Costco’s business model is great, all customers need to search out good quality bargains, and Costco is set up to keep their customers returning to search out them.

Costco has also made a significant investment in the development of Kirkland signature, a private label brand known for its high quality and lower prices than other national brand products.

This has enabled the corporate to differentiate its merchandise offerings with the additional advantages of additionally supporting higher margins.

Thus, Costco is positioned for solving key friction for retail consumers between the desire for high

quality and a version of high prices. This model has proven to be well known among customers and has become famous for its loyalty.

Despite there having been very few hurdles to cancellation and opt-in renewable programs, the annual renewal rates have averaged 90% since 2010.

This allowed Costco to weather cyclical downturns way more comfortably as compared to traditional retailers and enabled the stock price to boost at a rate consistently ahead of the S&P five hundred index for a longer duration.

However, conditions in the retail sector have forced Costco to increase membership fees in 2017; however, this has not sparked a material decrease in renewal rates.

Costco’s most prominent geographical market, without a doubt, remains the United States, although it has an established history of international growth.

Price Club, one of two corporations that incorporate to form Costco in 1993, opened its first multinational warehouse in 1992 in Mexico City.

After that, the firm has started operations in 9 other international markets and is currently looking to follow Walmart into the Chinese retail space.

Sales growth is the most significant driver of Costco’s profitability, especially in comparable sales (sales from warehouses open exceeding one year).

There are two methods to achieve Comparable sales growth, i.e., by increasing shopping frequency from new and existing members and secondly the money spent on every visit.

The integral and significant financial drivers of its business are its membership format, and the ability to control costs is an essential and vital part of its business model.

Significantly, over the previous year, the company has managed to produce significant, balanced upgrades across all key sales metrics. In FY2017, net sales increased nine percent to $126B billion, membership fee income rose 8% to $2.85 billion, and net income rose 14% to $2.68 billion.

How Does Costco Business Make Money?

Costco Wholesale Corporation. (COST) is a big-box merchandiser, and a wholesale warehouse club is operating roughly 800 locations in North America, Asia, and Europe.

It also has a significant e-commerce operation. The company’s warehouses provide low costs on a restricted choice of each name complete and personal label product, generally given in bulk volumes.

Consumers purchase memberships to access the warehouses and make purchases. Costco aims to supply lower costs than competitors by getting merchandise directly by limiting store hours of operation, and manufacturing and minimizing labor by storing merchandise on massive racks on top of a vast, self-service warehouse sales floor.

Costco presents merchandise in categories including Food and Sundries; Hardlines like major appliances, electronics, and hardware; fresh Foods; Softlines like apparel and small appliances; and ancillary, which includes fuel and pharmacy products.

The corporate additionally generates a tiny proportion of revenue through membership fees. Costco’s main competitors include discount stores like Target Corp. (TGT) and Walmart inc. (WMT), furthermore, as big-box rivals like B.J.’s Wholesale Club Holdings inc. (B.J.).

Costco Business Funding, Valuation & Revenue:

Costco is a membership solely warehouse that generates a majority of its revenue from retail sales and a small share from membership fees.

Customers should get memberships to access the warehouse and make purchases. This is often executed through direct sourcing and efficient inventory management techniques.

Costco divides its business into three segments: U.S. Operations, Canadian Operations, and alternative International Operations.

These three business segments are reported by revenue and operative financial gain. Of the 3, the U.S. Operations were the biggest, followed by Canadian Operations.

Costco is registered under the ticker NASDAQ: COST.Costco has made 2 investments. Their most recent investment was on Feb 9, 2021, when Fearless Fund raised $1M.Costco has invested in Fearless Fund on Feb 9, 2021. This investment – Funding Round – Fearless Fund – was valued at $1M.Costco has acquired Innovel Solutions on Mar 17, 2020. They acquired Innovel Solutions for $1B. (Source: www.crunchbase.com)

As of April 16, 2021, Costco has a net worth of $160.72B